Introduction: Why a CFO Dashboard Is Essential in Today’s Business Environment

The Chief Financial Officer position now requires duties that go beyond financial reporting and accounting because of contemporary business needs. The modern CFO functions as a strategic leader who requires immediate financial data access to direct business operations and protect assets and discover new business expansion possibilities.

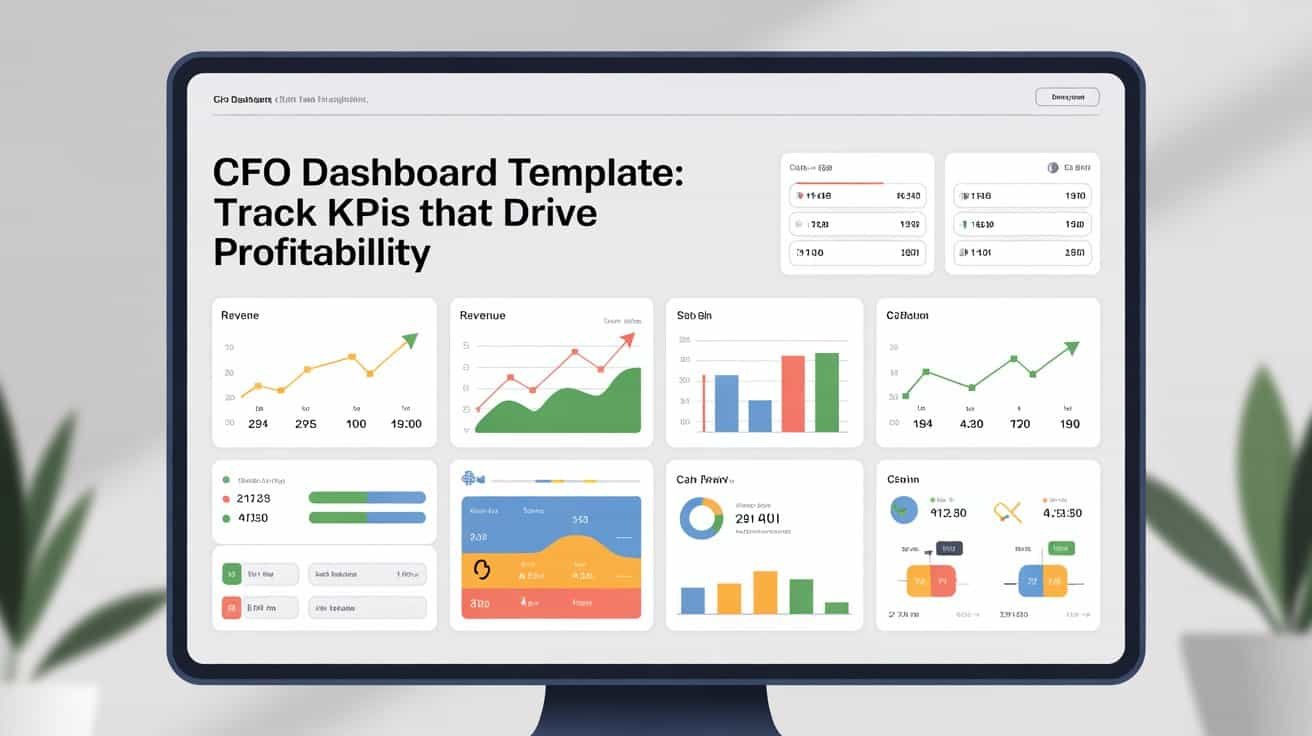

The fast business environment needs immediate financial data access because standard end-of-month reports and spreadsheet analysis do not fulfill present requirements. A CFO dashboard solves this problem through its ability to merge vital performance indicators into a basic visual interface. The dashboard provides financial leaders with instant decision-making capabilities through exact data which supports their goal to defend business profitability and sustainability.

The CFO position has undergone significant changes since its first creation.

The CFO used to focus mainly on financial data protection and regulatory compliance management. Financial executives need to take on additional responsibilities because organizations now need their leaders to handle more than financial duties.

The contemporary CFO serves as a performance driver who creates strategic plans to drive organizational success through his direct financial impact. The CFO supports value creation initiatives through board meetings with the CEO to achieve this goal by working with all company departments.

Financial data combined with dashboard technology enables the creation of analytical tools which demonstrate effectiveness.

Financial dashboards provide advantages which go past their fundamental user-friendly features. The system organizes complicated systems through its structured design which helps users understand them better.

The dashboard unites financial data from various business systems including accounting platforms and enterprise resource planning software and other applications to create a single financial performance dashboard. The dashboard system enables better team decision-making because its unified structure enables teams to collaborate more efficiently.

The dashboard system enables better communication through its ability to present complex information as simple visual elements which users can understand easily. The dashboard uses visual elements to present financial data which converts numerical information into easy-to-understand stories. The system eliminates manual reporting tasks and reduces errors which enables CFOs to dedicate their time to strategic financial analysis instead of data collection.

What Is a CFO Dashboard Template?

A CFO dashboard template functions as a pre-configured framework which presents essential financial data through visual and interactive displays. The template serves as a base to build personalized dashboards which meet your organization’s financial objectives and reporting requirements.

Finance leaders can establish KPI dashboards through pre-designed templates which enable them to support executive decisions without starting their work from the beginning.

The template contains sections which monitor revenue performance and track expenses and analyze profitability and manage cash flow operations. The dashboard includes separate sections for accounts receivable management and accounts payable management and working capital performance evaluation.

The template design shows complete financial performance data through its flexible design which works for various business types and organizational systems.

The CFO dashboard needs to show all vital financial performance indicators.

A dashboard needs financial performance indicators to fulfill its design requirements. The first essential metric for dashboard tracking requires dashboard users to monitor revenue performance and analyze expense patterns.

The financial metrics demonstrate revenue pattern changes throughout time while showing the company’s success in managing its expenses. The early detection of business growth or problems becomes possible through trend monitoring which allows CFOs to take prompt corrective actions.

Business success depends on two vital performance indicators which consist of gross margin and net profit. The business efficiency and profitability become visible through these performance indicators. The direct cost management abilities of a company become visible through its gross margin performance while net profit shows the company’s final financial results. The two indicators function together to determine how strategic initiatives produce financial results.

Financial stability depends on two vital performance indicators which consist of cash flow and liquidity. The tracking of cash inflows and outflows enables CFOs to verify that their organization maintains enough funds to fulfill all its financial obligations. The combination of burn rate analysis with cash on hand monitoring and cash flow projection tools enables better short-term planning and risk management.

Business operational efficiency becomes more apparent through the analysis of accounts receivable and payable metrics. The two operational metrics days sales outstanding and days payable outstanding show how well the company manages its customer payment cycle and vendor payment schedule. Organizations can obtain more working capital through improved ratios which decreases their financial obligations.

The selection of dashboard development tools depends on business size and operational complexity and available technical expertise. Small organizations together with businesses requiring operational adaptability select Excel as their main solution. The platform enables users to build dashboards while running mathematical operations through its system which provides full manual operation and fundamental automation features.

Best Practices for Designing a CFO Dashboard

The development of an effective dashboard requires finance leaders to create systems which combine simplicity with user-friendly design. The most effective dashboards provide users with instant insights which enable them to begin taking immediate action.

The system requires basic visual elements to display data which users can understand through numerical information. The dashboard should display financial data through visual charts and graphs and summary indicators which show performance patterns and relative values.

The dashboard design needs to follow the strategic objectives which the organization has established. The CFO needs to choose essential performance indicators which generate business results instead of showing all available metrics. The dashboard maintains its value and business alignment because it focuses on essential performance indicators which drive organizational success.

Conclusion: Empower Your Finance Function with Data-Driven Insights

A CFO dashboard template functions as a strategic business tool which enables financial leaders to lead their organization through data-driven decisions. The dashboard platform combines vital financial data into one platform which enables active financial control and immediate decision support and improved profitability focus. Bizinfograph offers ready-to-use dashboard templates on Finance, Sales, HR and Manufacturing.

Disclaimer: The information provided is for general informational purposes only. It is not intended as financial or business advice. Always consult a professional before making any business decisions. The use of dashboards may vary based on specific organizational needs and resources.